Historically, giant commodity traders such as Switzerland's Vitol, Glencore, and Gunvor as well as Singapore’s Trafigura have dominated the global oil trade while smaller trading desks that lack the wherewithal and deep infrastructure networks of the giants usually feed on crumbs. The same case applied to the Russian market before Russia invaded Ukraine, with Trafigura moving ~850,000 barrels of Russian crude per day at its peak. But the oil hegemony has now been severely disrupted thanks to Russia’s war. Bloomberg has reported that six little-known companies based in Hong Kong and Dubai now dominate Russian oil trade with the traditional leaders no longer in the picture.

According to Bloomberg, Russian customs data for the final four weeks of 2022 shows that Nord Axis Ltd, Tejarinaft FZCO,QR Trading DMCC, Concept Oil Services Ltd, Bellatrix Energy Ltd and Coral Energy DMCC together handled about 1.4 million barrels a day of Russian crude oil. That’s more oil than what the commodity giants typically handled before the war in Ukraine, and enough to meet the entire needs of countries such as the UK and Italy.

Interestingly it’s Nord Axis, a company that was incorporated just a year ago in Hong Kong, that emerged as the biggest buyer, moving 521,000 barrels of Russian crude per day. Nord Axis was virtually unknown in the oil market until it bought Trafigura’s stake in Rosneft’s flagship oil project Vostok Oil in July. Dubai-based Tejarinaft FZCO was the second largest buyer after it purchased 244,000 barrels a day from Rosneft while Dubai-based QR Trading DMCC was the third-largest buyer, moving 199,000 barrels a day from Surgutneftegas PJSC. Other top buyers were Hong Kong’s Concept Oil Services Ltd (152,000 b/d), Hong Kong-based Bellatrix Energy Ltd (151,000 b/d) and Dubai’s Coral Energy DMCC (121,000 b/d).

Source: Bloomberg

It’s not clear how these traders were able to finance the large flows of Russian oil, with Bloomberg estimating it was worth more $2 billion over the month of December.

Even more perplexing is the fact that Nord Axis, QR Trading DMCC and Bellatrix Energy Ltd were unknown entities before the west abandoned the Russian energy markets. Bloomberg has established that Bellatrix received loan facilities from Russian banks including Rosneft-owned Russian Regional Development Bank and Russian Agricultural Bank, though calls or emails to these traders, their banks and Russian oil producers have gone unanswered.

“Knowing who the big names are is an important step in understanding how oil markets are responding to the price cap and wider sanctions,” Steve Cicala, co-director of the Project on the Economic Analysis of Regulation at the National Bureau of Economic Research, has told Bloomberg.

Meanwhile, other experts have decried the opacity of Russian oil markets, “We’re coming to this with a lot of humility and we’re just asking that everyone else can adopt the same level of uncertainty. These are really opaque markets, the data’s not great on it. Let’s just acknowledge that from the outset when we’re making conclusions,” U.S. Assistant Treasury Secretary Ben Harris has told Bloomberg.

Russian Oil Flows Holding Up, But Not Forever

Last year, against all odds, Russia managed to grow its oil output despite being hit with tough sanctions, a plethora of oilfield service companies exiting the country as well as the refusal by western countries to buy its crude for the most part.

Indeed, Energy Intelligence reports that in 2022, Russia’s crude and condensate production increased 2%, with oil production clocking in at 10.73 million b/d, above Russia's ministry for economic development forecast of 10.33 million b/d.

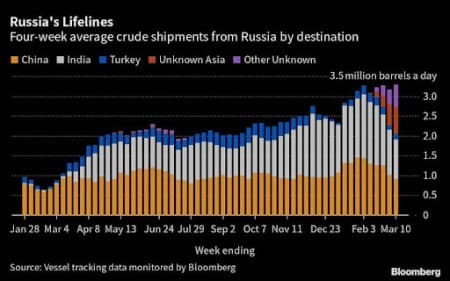

Russia managed to pull off this feat mainly by offering huge discounts to buyers like China and India, with Bloomberg's oil strategist Julian Lee reporting that the two were receiving discounts of $33.28 per barrel, or about 40% to international Brent crude prices oil at the time.

But Moscow cannot continue defying the odds indefinitely. BP Plc (NYSE: BP) has predicted that the country’s output is likely to take a big hit over the long-term, with production declining 25%-42% by 2035. BP says that Russia's oil output could decrease from 12 million barrels per day in 2019 to 7-9 million bpd in 2035 thanks to the curtailment of new promising projects, limited access to foreign technologies as well as a high rate of reduction in existing operating assets.

ADVERTISEMENT

In contrast, BP says that OPEC will become even more dominant as the years roll on, with the cartel’s share in global production increasing to 45%-65% by 2050 from just over 30% currently. Bad news for the bulls: BP remains bearish about the long-term prospects for oil, saying demand for oil is likely to plateau over the next 10 years and then decline to 70-80 million bpd by 2050.

That said, Russia might still be able to avoid a sharp decline in production because many of the assets of oil companies that exited the country were abandoned or sold to local management teams who retained critical expertise.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Standard Chartered Blames Gamma Hedging For Overdue Oil Selloff

- Oil Prices Near $75 As Russia Extends Output Cut Through June

- Bank Turmoil Could Undermine The Effect Of Biden’s Clean Energy Bill

The claim by Bloomberg that Russia managed to pull off this feat mainly by offering huge discounts to buyers like China and India of $33,28 per barrel or about 40% to international Brent crude prices at the time was discredited completely by US researchers at the Institute of International Finance at Columbia University and the University of California who said Russia has been selling its crude at $74.0 a barrel which is far higher than the cap of $60.0. This means that Russian discounts were only $6.0-$10 below Brent crude price.

Moreover, BP’s prediction that Russia’s crude production is likely to decline by 25%-42% by 2025 to 7.0-9.0 mbd as a result of what BP claims as a curtailment of new promising projects, limited access to foreign technologies as well as a high rate of reduction in existing operating assets is as false and void as the claim by BP’s CEO Bernard Looney at the height of the pandemic in mid-2020 that peak oil demand is now behind us. He was forced to retract his words last year at the World Energy Congress in Abu Dhabi. In fact Russia’s Vostok project in the Arctic is going from strength to strength without Western technology or finance with Russian oil giant Rosneft expected to add 1.5 mbd to Russian crude production by 2025/26.

And contrary to misguided claims by BP that global oil demand is likely to plateau over the next 10 years and then decline to 70-80 mbd by 2050, global oil demand will continue to rise albeit at a slightly decelerating rate throughout the 21st century and probably far beyond underpinned by a world population projected to rise from 8.0 billion currently to 9.7 billion by 2050 and a global GDP expected to grow from $97 trillion now to $245 trillion by 2050. The only factors which could depress global demand is a total depletion of global oil reserves which is unthinkable or discovering or developing an alternative to oil as versatile and practicable as oil itself which is highly unlikely in the next 100 years.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert