Non-Fungible Token (NFT) Market Towards USD 745.4 Billion By 2034, CAGR of 39.40%

Non-Fungible Token (NFT) market

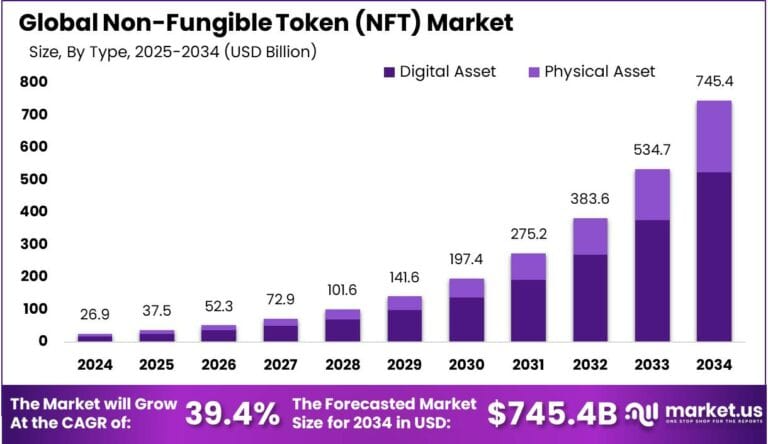

Global NFT Market to hit $745.4B by 2034, surging from $26.9B in 2024 at 39.4% CAGR. North America led with $9.2B (34.3%), US at $7.38B.

NEW YORK, NY, UNITED STATES, February 4, 2025 /EINPresswire.com/ -- According to the Market.us, The Global Non-Fungible Token (NFT) Market is projected to experience explosive growth, reaching USD 745.4 billion by 2034, a massive leap from USD 26.9 billion in 2024. This translates to a CAGR of 39.4% between 2025 and 2034, highlighting the increasing demand for digital ownership across various industries. In 2024, North America dominated the NFT market, accounting for 34.3% of the global share, generating USD 9.2 billion in revenue. Within the region, the United States played a key role, contributing an impressive USD 7.38 billion.

The rapid adoption of blockchain technology, coupled with rising interest in digital art, gaming, and tokenized assets, is fueling this growth. As institutional investors and major brands enter the space, the NFT market is set for a strong expansion in the coming years. The NFT market's growth is primarily driven by the increasing adoption of blockchain technology which provides a secure and decentralized platform that facilitates the minting, buying, and selling of digital assets. Moreover, the integration of NFTs into various sectors such as art, gaming, and collectibles has broadened the scope and appeal of NFTs, attracting a diverse range of buyers and investors.

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=138213

The demand in the NFT market is highly influenced by the collectibles and art segments. Collectibles have dominated the market due to their versatility and the emotional connection they offer to enthusiasts. Meanwhile, the art segment is projected to grow at the fastest rate within the market, driven by digital artists and increasing online art transactions.

Emerging trends and innovations within the NFT space, such as hybrid NFTs that offer both collectibility and investment opportunities, and fractional ownership that allows buyers to own parts of high-value NFTs, present new opportunities for market expansion. Additionally, the increasing use of NFTs in industries like gaming, where they are used to represent in-game assets, offers further growth prospects.

Technological developments play a crucial role in shaping the NFT market. The use of smart contracts on platforms like Ethereum has made transactions more secure and transparent, reducing the need for intermediaries and fostering trust among users. Innovations in blockchain technology continue to enhance the functionality and efficiency of NFT transactions, making it easier for users to create, buy, and sell NFTs.

👉 𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞 𝐈𝐦𝐩𝐚𝐜𝐭𝐟𝐮𝐥 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬: https://market.us/report/non-fungible-token-nft-market/free-sample/

NFT Market Analysis: Growth Pockets Amid a Cooling Industry

The NFT market remains a mixed landscape, reflecting both setbacks and areas of renewed interest. While overall market enthusiasm has cooled significantly since its peak in 2022, certain segments, like blockchain gaming, continue to attract strong investor confidence.

Ownership Trends: A Generational Divide

NFT adoption is heavily influenced by age demographics. According to Kraken, 5% of adults aged 18-34 own NFTs globally, but ownership declines sharply among older generations. Among individuals over 55, only 1% report owning an NFT, highlighting a generational gap in digital asset adoption. Singapore stands out as a global leader in NFT ownership among young adults, with 9% of people aged 18-34 holding at least one NFT.

Trading Volumes: Signs of Stabilization?

After the NFT market frenzy of 2022, trading volumes have taken a significant hit. In Q1 2024, trading volume stood at $3.9 billion, a steep drop from the $12.6 billion recorded in Q1 2022. However, Q2 2024 brought a slight rebound, with volumes climbing to $4 billion from 14.9 million sales—the highest quarterly performance since early 2023. While these figures are far from previous highs, they indicate a potential stabilization rather than a continued freefall.

Blockchain Gaming: A Bright Spot in the Market

One of the most promising areas within the NFT space is blockchain gaming. In Q2 2024 alone, gaming companies secured $1.1 billion in investments, signaling strong investor interest in this segment. Unlike traditional NFT collectibles, blockchain gaming integrates NFTs into gameplay mechanics, creating real-world utility and potential long-term adoption.

Market Risks: Rising Scams and Fraud Losses

Despite these encouraging signs, the NFT market still faces challenges. Losses from crypto-related scams, hacks, and frauds increased by 5% in 2024, reaching a total of $430 million lost. Security remains a major concern for both investors and platforms, reinforcing the need for stronger regulatory frameworks and consumer protection measures.

𝐁𝐮𝐲 𝐨𝐮𝐫 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐚𝐭 𝐀𝐟𝐟𝐨𝐫𝐝𝐚𝐛𝐥𝐞 𝐏𝐫𝐢𝐜𝐞𝐬 𝐍𝐨𝐰: https://market.us/purchase-report/?report_id=138213

Market Analysis & Growth

The global Non-Fungible Token (NFT) market is on a rapid growth trajectory. In 2024, the market stood at USD 26.9 billion, and it is projected to expand significantly, reaching USD 745.4 billion by 2034. This remarkable growth is driven by a compound annual growth rate (CAGR) of 39.40% between 2025 and 2034.

In 2024, the Digital Asset segment dominated the NFT space, holding a 70.4% market share. This segment includes digital art, music, videos, and virtual goods, which continue to attract both creators and investors.

NFT Collectibles also played a significant role in the market’s expansion. This segment captured 32.6% of the total market share in 2024. The growing popularity of rare digital items, trading cards, and exclusive limited-edition NFTs has fueled demand.

The Personal segment emerged as the largest contributor to the NFT industry, accounting for 67.3% of the market share in 2024. Individual investors, artists, and content creators increasingly use NFTs to tokenize personal assets and build digital ownership.

North America retained its dominant position in the NFT industry in 2024, capturing a 34.3% market share with total revenues of USD 9.2 billion. The region’s well-established digital economy, strong investor interest, and widespread adoption of blockchain technology contributed to its leadership.

The United States remained the largest player within the NFT ecosystem, with a market valuation of USD 7.38 billion in 2024. The country continues to drive innovation, with major NFT platforms, artists, and collectors fueling growth.

Market Dynamics

NFT Market Driver: Increasing Adoption of Digital Assets

The non-fungible token (NFT) market is experiencing significant growth, primarily driven by the increasing adoption of digital assets. Consumers and creators are exploring NFTs as unique ownership opportunities, which have opened new streams of income for artists and introduced new forms of social and economic interactions through virtual marketplaces. The appreciation for digital assets, bolstered by pop culture, has enhanced the market's growth, with tokenization of art, music, and in-game items at the forefront. The expansion of NFT platforms is also fueled by their applications spreading across industries like fashion, sports, and real estate, creating a robust environment for market expansion.

NFT Market Restraint: Market Complexity and Regulatory Uncertainty

Despite the market's growth, there are significant restraints, including market complexity and regulatory uncertainty. The lack of standards and confusion surrounding NFTs and blockchain technology pose challenges. Issues like intellectual property rights, price fluctuations, and the risk of fraud have created burdens for both platform providers and users. The ongoing global regulatory scrutiny, as governments attempt to understand and control digital assets, deters investment and reduces user confidence, impacting the market's stability and growth potential.

NFT Market Opportunity: Integration with Traditional Industries

The NFT market presents substantial opportunities through its integration with traditional industries. Increased collaborations with mainstream brands, artists, and companies to create digital collectibles, access rights, and tokenized assets are poised to expand the market. New use cases in virtual real estate, fashion, and ticketing, facilitated by NFTs, are expected to drive rapid adoption across varied and dynamic consumer segments. This integration supports a thriving market ecosystem, inviting more players and investments into the space.

NFT Market Challenge: Regulatory and Security Concerns

One of the major challenges in the NFT market is the regulatory and security uncertainty that accompanies the growth of this sector. Regulators struggle with classifying and regulating NFTs, leading to a variety of constraints or inconsistent regulations across different regions. Additionally, risks of fraud related to NFTs, ranging from hacks to weak consumer rights, pose significant threats. These issues complicate the development of secure, compliant platforms and hinder the scale of adoption, making it a critical area for market stakeholders to navigate carefully.

Key Market Segments

By Type

Physical Asset

Digital Asset

By Application

Collectibles

- Video Clip

- Audio Clip

- Gamification

- Others

Art

- Pixel Art

- Fractal/Algorithmic Art

- Computer Generated Painting

- 2D/3D Painting

- 2D/3D Computer Graphics

- GIFs

- Others

Gaming

- Trading Card Game (TCG)

- Video Game

- Strategy Role Playing Game (RPG)

- Others

Utilities

- Tickets

- Domain Names

- Assets Ownership

Metaverse

Sports

Others

By End-use

Personal

Commercial

Top Key Players in the Market

YellowHeart, LLC.

Cloudflare, Inc.

PLBY Group, Inc.

Dolphin Entertainment, Inc.

Funko

Ozone Networks, Inc.

Takung Art Co., Ltd.

Dapper Labs, Inc.

Gemini Trust Company, LLC.

Onchain Labs, Inc.

Others

Explore More Reports

➤Responsible AI Market- https://market.us/report/responsible-ai-market/

➤Privacy Enhancing Technologies Market- https://market.us/report/privacy-enhancing-technologies-market/

➤Credit Scoring and Fraud Market- https://market.us/report/credit-scoring-and-fraud-market/

➤Agentic AI Architecture Market- https://market.us/report/agentic-ai-architecture-market/

➤Agentic AI for Consumer Applications Market- https://market.us/report/agentic-ai-for-consumer-applications-market/

➤Agentic AI in Smart Cities Market- https://market.us/report/agentic-ai-in-smart-cities-market/

➤Cloud Computing in Oil & Gas Market- https://market.us/report/cloud-computing-in-oil-gas-market/

➤Digital Receipts in Retail Market- https://market.us/report/digital-receipts-in-retail-market/

➤Stand-Alone Radio Receivers Market- https://market.us/report/audio-semiconductor-market/

➤Audio Semiconductor Market- https://market.us/report/audio-semiconductor-market/

➤Legacy Chips Wafer Foundry Market- https://market.us/report/legacy-chips-wafer-foundry-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release