Best Personal Loans for Bad Credit Guaranteed Approval 2025: Top Provider with No Credit Check & Fast Approval - LowCreditFinance

/EIN News/ -- New York City, NY, May 19, 2025 (GLOBE NEWSWIRE) --

Secure Emergency Loans for Bad Credit with Guaranteed Approval – Explore Leading No Credit Check Lenders for Quick and Reliable Funding Solutions in 2025

When life throws unexpected expenses your way, finding a trustworthy lender—especially with less-than-perfect credit—can feel overwhelming.

That’s where LowCreditFinance comes in. As one of the leading bad credit loan providers in 2025, LowCreditFinance specializes in connecting borrowers of all credit backgrounds with fast, reliable funding solutions.

Whether you need cash for an emergency, to consolidate debt, or to cover a major purchase, their user-friendly online platform makes the process simple and stress-free.

With a vast network of reputable lenders, same-day approval decisions, and flexible repayment terms, LowCreditFinance puts financial control back in your hands.

Even if you’ve been turned down elsewhere, their inclusive approach ensures you have access to the funds you need—quickly, securely, and with complete transparency.

Top Personal Loans for Bad Credit Guaranteed Approval Options Today

LowCreditFinance Review: A Friendly Guide to Fast Loans for All Credit Types

< CLICK to view top loan providers with no credit check >

Introduction: Your Financial Partner in Tough Times

Life is full of surprises—some good, some not so much. Whether it’s an unexpected car repair, medical bill, or an opportunity you can’t pass up, sometimes you need extra cash, and you need it fast. If your credit isn’t perfect, this can feel overwhelming. That’s where LowCreditFinance steps in.

Low Credit Finance specializes in helping people with all credit backgrounds—including those with poor or no credit—quickly find a loan that fits their needs. With a simple, secure online process and a network of lenders, they’re dedicated to making borrowing less stressful and more accessible for everyone.

What is LowCreditFinance?

Low Credit Finance isn’t a direct lender—they don’t issue loans themselves. Instead, they operate as a loan-matching service, connecting borrowers with a large network of lenders and alternative loan providers. Their platform makes it easy to submit a single application and get matched with multiple options, saving customers time and hassle.

< Click here to see how LowCreditFinance works >

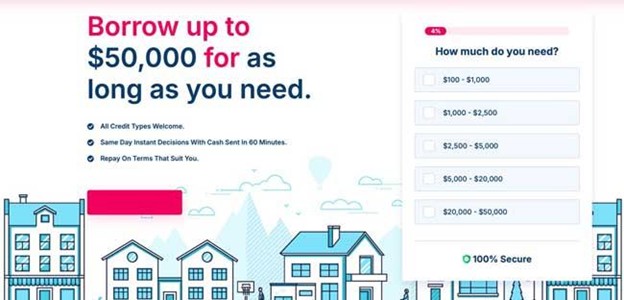

Key Features:

- Borrow amounts from $100 up to $50,000

- All credit types welcome

- Same-day online decisions

- Funds can be sent in as little as 60 minutes

- Flexible repayment terms

- 100% secure application process

How the Application Process Works

Applying for a loan with Low Credit Finance is straightforward and can be done entirely online. Here’s what you can expect:

Step 1: Choose Your Loan Amount

You start by selecting how much you need to borrow. Amounts range from $100 for small emergencies to $50,000 for larger expenses like debt consolidation or home repairs.

Step 2: Fill Out a Simple Online Form

The application form is user-friendly and only takes about two minutes to complete. You’ll provide basic details such as your contact information, approximate credit score, employment status, income, and bank account details (for direct deposit of funds). They also ask for information like your driver’s license and Social Security number to verify your identity and prevent fraud.

Step 3: Get Matched with Lenders

Once you submit your application, Low Credit Finance’s proprietary matching software searches their network for lenders that fit your profile. You’re then presented with one or more loan offers that you can review and choose from.

Step 4: Receive Your Funds

If approved by a lender, you could receive your money on the same business day—sometimes within 60 minutes. The funds are deposited directly into your bank account.

< Need an emergency loan but have bad credit? - CLICK HERE >

Who Can Apply?

One of the standout features of Low Credit Finance is their all-credit-welcome approach. Whether you have excellent, fair, poor, or even no credit, you can apply. Here are some basic eligibility points:

- You must be at least 18 years old.

- You need a valid checking or savings account for deposits.

- You must provide proof of income (job, self-employment, benefits, or military income are all accepted).

- You’ll need to share some personal and financial details for verification.

< Apply for a personal loans with no credit check - CLICK HERE >

Loan Types and Flexibility

Low Credit Finance caters to a wide range of needs and situations. Their lenders offer:

- Personal Installment Loans: Borrow larger amounts and repay over months or years with fixed monthly payments.

- Short-Term Loans: Ideal for emergencies and quick cash needs.

- No Credit Check Loans: Some lenders may offer loans without a traditional credit check, though terms may vary.

- Flexible Repayment: Choose a repayment plan that matches your pay schedule and budget.

With such variety, you’re likely to find a loan option that fits your circumstances—even if you’ve been turned down elsewhere.

Speed and Convenience

One of the biggest advantages of using Low Credit Finance is how fast everything moves. The online application is simple, and you can receive a lending decision almost instantly. If you’re approved, the funds could be in your bank account in as little as an hour. This makes Low Credit Finance a great choice for anyone facing urgent financial needs and can’t afford to wait days or weeks for traditional approval.

Security and Privacy

Applying for a loan online means sharing sensitive information, so security is a big concern. Low Credit Finance uses advanced encryption and privacy measures to ensure your data stays safe. All information submitted is 100% secure, and they’re transparent about how your information is used—primarily to match you with the best lender.

Fees, Rates, and Transparency

Low Credit Finance itself does not charge any fees for using their service. Instead, they receive compensation from lenders if you accept a loan offer. This means you can use their platform to shop around for free.

APR rates from their network of lenders range from 5.99% to 35.99%. The exact rate and terms depend on your creditworthiness, the loan amount, and the lender’s policies. Before you accept any loan, make sure you review the terms carefully, including fees, interest rates, and repayment schedules. Low Credit Finance encourages borrowers to compare options and make informed decisions.

What Do Customers Say?

Customer reviews highlight the speed, simplicity, and accessibility of Low Credit Finance’s service. Many users appreciate being able to apply with bad credit and still receive offers, sometimes within minutes. The easy-to-follow application and clear communication from lenders are also frequently praised.

As with any loan service, experiences can vary based on individual circumstances and the lenders you’re matched with. Always read the fine print and ask questions if anything is unclear.

Customer Support

Should you have any questions or concerns, Low Credit Finance offers 24/7 email support at support@lowcreditfinance.com. Their FAQ section also covers common questions about the application process, eligibility, and what to expect.

Things to Consider

While Low Credit Finance offers many benefits, it’s important to remember:

- They are not a direct lender; they connect you with lenders.

- Loan approval and terms depend on the lender’s requirements.

- Always review loan offers carefully and compare multiple options.

- Some lenders may perform a credit check or require additional information.

Is Low Credit Finance Right for You?

If you need quick access to funds and worry your credit score will hold you back, Low Credit Finance is worth considering. Their easy application, broad lender network, and commitment to helping people with all credit backgrounds make them a standout option for emergency borrowing or larger financial needs.

With no upfront fees, a secure process, and the potential to receive funds in just 60 minutes, Low Credit Finance puts fast, flexible loans within reach—even if your credit history isn’t perfect. As always, borrow responsibly, review your options carefully, and choose a loan that fits your budget. For many, Low Credit Finance could be the helping hand you need when life throws you a curveball.

Introduction to Personal Loans

Life can be unpredictable, and sometimes, unexpected expenses pop up when you least expect them—whether it’s a medical bill, urgent car repair, or an opportunity you don’t want to miss. For many people, especially those with less-than-perfect credit, finding a way to cover these costs can feel overwhelming. That’s where personal loans come in, offering a lifeline when you need it most.

What Are Personal Loans and How Do They Work?

Think of a personal loan as a helping hand for life’s expenses. Unlike a mortgage or a car loan, which are tied to specific purchases, personal loans are what’s called “unsecured”—you don’t have to put your house or car on the line to qualify. Instead, you borrow a lump sum and pay it back in fixed monthly installments over a set period, usually between one and five years.

What makes personal loans so useful is their flexibility. You can use the funds for just about anything: consolidating high-interest credit card debt, making home improvements, covering emergency medical expenses, or even planning a special event. The freedom to choose how you use the money is a big part of their appeal.

Options for People with Bad Credit

If your credit score isn’t perfect, you might feel like your options are limited. But the good news is that there are personal loans designed specifically for people with bad credit. These lenders understand that a credit score doesn’t tell the whole story and are willing to look at your overall financial picture, such as your income and ability to repay.

Some lenders even offer “guaranteed approval” loans, meaning your chances of getting approved are much higher—even if your credit history has a few bumps. And in many cases, you won’t need to undergo a traditional credit check, which can be a relief if you’re worried about another inquiry hurting your score.

Fast and Convenient Applications

Gone are the days of filling out stacks of paperwork and waiting weeks for a decision. Today, applying for a personal loan is usually quick and easy. Most lenders offer online applications that you can complete from the comfort of your home—sometimes in just a few minutes. You simply enter some basic information, and in many cases, you’ll get an answer within hours.

If you’re approved, the money can often be deposited into your bank account as soon as the same business day. This speed can make all the difference when you’re dealing with an emergency or time-sensitive expense.

Flexible Repayment That Fits Your Life

One of the biggest sources of financial stress is not knowing how much you’ll owe from month to month. That’s why the structure of personal loans can be such a relief. With fixed monthly payments, you get predictability—no more guessing or worrying about surprise bills. You know exactly how much to set aside each month, which makes planning your budget a whole lot simpler.

But the flexibility of personal loans goes beyond just predictable payments. Many lenders understand that life isn’t always smooth sailing, so they offer options that help you stay in control, even when things get bumpy. For example, you might be able to select your own payment date, aligning it with your payday or another time that works best for you. This little detail can make a big difference, helping you avoid late fees and unnecessary stress.

Some lenders also allow you to make extra payments without any penalties. This means if you ever have a little extra cash—maybe from a bonus at work or a tax refund—you can put it toward your loan and pay it off faster. Not only does this save you money on interest, but it can also give you a real sense of progress and empowerment as you watch your balance shrink.

Having this kind of flexibility is especially important if you’re working to rebuild your credit. On-time payments are one of the most important factors in your credit score, and being able to stick to a manageable payment schedule makes it much easier to stay on track. As you make those consistent payments, you’re not just chipping away at your debt—you’re also showing future lenders that you’re responsible and creditworthy.

Ultimately, personal loans with flexible repayment options offer more than just money—they provide peace of mind. They give you breathing room and the tools you need to move forward financially, one manageable step at a time.

Clear Terms and Peace of Mind

When it comes to borrowing money—especially if you’ve had credit challenges in the past—there’s nothing more important than feeling confident and secure about your decision. Unfortunately, the world of loans can sometimes feel like a maze of jargon, hidden fees, and terms buried in the fine print. That’s why working with lenders who are clear and upfront about their terms makes such a huge difference.

A transparent personal loan provider will lay everything out for you: the interest rate, the total amount you’ll repay, the monthly payment, and any fees involved. There shouldn’t be any surprises, and you should feel comfortable asking questions. If something isn’t clear, a trustworthy lender will take the time to explain it in plain language. This openness not only protects you from unexpected costs but also builds trust—something that’s priceless when your finances are on the line.

This kind of clarity is especially important for people with bad credit, who may have already dealt with overwhelming debt or confusing lending terms in the past. Knowing exactly what you’re signing up for allows you to plan ahead and avoid falling into the traps that can make financial recovery even harder.

Taking out a personal loan is a big step, and it’s normal to feel nervous. But when you can see all the details up front, it’s easier to move forward with confidence. You can compare offers, weigh the pros and cons, and make a decision that truly fits your situation.

In the end, clear terms and honest communication aren’t just nice to have—they’re essential. They help turn what could be a stressful experience into a manageable one, giving you the peace of mind you need to focus on your goals and build a brighter financial future.

Understanding Credit Scores: Why They Matter for Personal Loans

After finding a loan with clear terms and flexible repayment, you might start to wonder: what role does your credit score really play in all of this? Understanding credit scores—and how they affect your loan options—can empower you to make better financial decisions and ultimately secure the best deal possible.

What Is a Credit Score and How Is It Calculated?

A credit score is essentially a three-digit number that represents your creditworthiness. It’s calculated based on your credit history, including how reliably you’ve paid your bills, how much debt you have, and how long you’ve been using credit. The most commonly used scoring model is the FICO score, which ranges from 300 to 850. In general, the higher your score, the more favorably lenders will view you.

How Credit Scores Affect Loan Approval and Interest Rates

When you apply for a personal loan, lenders look at your credit score as one of the main factors in their decision-making process. A high credit score usually means you’re more likely to be approved and to receive lower interest rates, which can save you a lot of money over the life of your loan. On the other hand, a low or “bad” credit score can make it harder to qualify and may result in higher interest rates.

That said, a poor credit score isn’t the end of the road. Some lenders specialize in personal loans for bad credit, offering guaranteed approval or more flexible criteria. These loans can provide a valuable opportunity to access funds when you need them, even if your credit history isn’t perfect.

Factors Beyond the Credit Score

It’s important to remember that your credit score isn’t the only thing lenders consider. They’ll also look at your income, employment status, debt-to-income ratio, and overall credit history. This means that even if your score is lower than you’d like, having steady income or a manageable debt load can help improve your chances of approval.

Building and Maintaining Good Credit

Maintaining a good credit score is one of the best ways to unlock better loan options and lower interest rates. Simple habits like paying bills on time, keeping credit card balances low, and checking your credit report regularly for errors can make a big difference over time. Even if you’re starting with bad credit, taking small, consistent steps can help you rebuild your financial reputation.

By understanding how credit scores work and how they impact your loan options, you’ll be better prepared to find a personal loan that fits your needs—now and in the future.

Credit History and Loan Approval: What Lenders Really Look For

By now, you’ve seen how your credit score can impact the personal loan process—but it’s only part of the bigger picture. When you apply for a loan, lenders don’t just check your score; they take a close look at your entire credit history. This gives them a fuller sense of how you’ve managed money over time, helping them decide if you’re a trustworthy borrower.

Your credit history is detailed in your credit report, which lists your past loans, credit card accounts, payment history, and any late or missed payments. If you’ve had some financial bumps, like missed payments or defaults, lenders might see you as a riskier borrower. This can sometimes mean higher interest rates or, in some cases, loan denial.

However, there’s good news—some lenders are more understanding and offer loans specifically designed for people with less-than-perfect credit. These lenders may focus more on your current income or the steps you’ve taken to get back on track, rather than just your past mistakes. Some even have minimal credit score requirements and put more weight on your ability to repay now, not just what’s happened before.

If you’re looking to improve your chances for the future, making on-time payments, reducing your debt, and avoiding too many hard credit checks are powerful ways to rebuild your credit history. Remember, lenders also look at your income, employment stability, and debt-to-income ratio. Being able to show steady income and responsible financial habits can go a long way.

Ultimately, while your credit history matters, it’s not the only thing that defines you as a borrower. There are always options and steps you can take to strengthen your application and move closer to your financial goals.

Types of Loans for Bad Credit: Exploring Your Options

If you’ve read this far, you know that getting a personal loan with bad credit isn’t impossible—there are actually several different options out there, each with its own advantages and drawbacks. Understanding the different types of loans available can help you choose the one that best fits your needs and financial situation.

Installment Loans: Flexibility and Predictability

Installment loans are one of the most popular choices for borrowers with bad credit. With these loans, you borrow a set amount of money and repay it over time in regular, fixed monthly payments. This structure makes it easier to budget, since you always know what your payment will be. Many people use installment loans for things like debt consolidation or home improvements, since the predictable payments and longer terms can make bigger expenses feel more manageable.

Payday Loans: Fast Cash, High Costs

Sometimes emergencies just can’t wait, and that’s where payday loans come in. These loans are designed to provide quick cash—often within a single business day. However, it’s important to be careful: payday loans typically come with very high interest rates and fees. While they can help cover urgent short-term expenses, the costs can add up quickly, making them a risky option if you’re unable to repay on time.

Unsecured Loans: No Collateral Required

Unsecured loans are another option for those with bad credit. Unlike secured loans, you don’t need to put up any collateral, like your car or home. This can make them more accessible, but it also means lenders may charge higher interest rates or have stricter repayment terms to offset the risk.

Tribal Loans: Unique Terms, Use Caution

Tribal loans are offered by lenders based on Native American tribal land. These loans can be accessible even to those with very poor credit, but borrowers should be cautious. Interest rates and fees for tribal loans can be extremely high, and the legal protections may differ from state-regulated loans.

Credit Check Loans: Favorable Terms for Good Credit

Credit check loans are a common type of personal loan where lenders review your credit report as part of the approval process. If you have a strong credit history and a solid score, these loans can offer some of the most attractive terms available. Lower interest rates, smaller fees, and longer repayment periods are all perks that come with proving your creditworthiness.

People often turn to credit check loans for big-ticket items like home improvements, medical procedures, or consolidating high-interest credit card debt. Because the lender is confident in your ability to repay, you may qualify for higher loan amounts and more flexible terms. This makes it easier to budget for larger expenses over time, without being hit by sky-high monthly payments.

However, approval criteria for credit check loans are typically stricter. Lenders will want to see not just a good credit score, but also a reliable income and manageable debt levels. If you meet these requirements, you could secure a loan with very competitive rates.

Before committing, it’s important to read the loan agreement carefully. Even with a strong credit profile, terms can vary between lenders, and it’s always wise to watch for any hidden fees or conditions. Taking the time to understand the fine print will help you make a confident, informed borrowing decision.

No Credit Check Loans: Fast Funding for Urgent Needs

For many people, the thought of a credit check can be intimidating—especially if your credit history is less than perfect. No credit check loans offer an alternative. These loans skip the traditional credit inquiry, focusing more on your current income and ability to repay. With more lenient approval criteria, they’re often available to those who have been turned down elsewhere.

No credit check loans are typically used for emergencies—like covering a surprise medical bill, urgent car repairs, or other expenses that simply can’t wait. The application process is usually quick and straightforward, sometimes providing funds within hours. This speed can be a lifesaver when time is of the essence.

However, convenience comes at a cost. Because these loans carry more risk for the lender, they often have higher interest rates and fees. Repayment terms are usually shorter and loan amounts smaller, which means you’ll need to pay the money back quickly.

While some lenders do offer flexible repayment options and try to keep fees transparent, it’s essential to read the terms carefully. High costs can add up fast, making it easy to fall into a cycle of debt if you’re not careful. No credit check loans can be useful in a pinch, but they should be approached with caution and used only for true emergencies.

Direct Lender Options: Simplicity and Speed

Navigating the loan marketplace can be overwhelming, especially when third-party brokers get involved. Direct lender options cut out the middleman, allowing you to apply and receive funds directly from the source. This can lead to a smoother process, faster approval, and sometimes lower interest rates, since there are no broker fees to worry about.

Direct lenders often offer more personalized loan experiences, tailoring terms to your financial situation. They may also have more flexibility in approving borrowers with less-than-perfect credit, making them a good choice if you need money quickly and don’t want to jump through extra hoops.

Applying directly can also mean a quicker funding timeline—sometimes as fast as the same or next business day. However, it’s still important to carefully review the loan’s terms, as some direct lenders may offset their flexibility with higher interest rates or stricter repayment conditions.

Doing a bit of research goes a long way. Comparing offers, checking for hidden fees, and reading reviews can help you find a reputable direct lender who’s transparent and trustworthy. Remember, the right lender should make you feel informed and comfortable, not pressured or rushed. By choosing a direct lender wisely, you can enjoy a smoother borrowing experience and greater peace of mind.

Understanding Annual Percentage Rate (APR): The True Cost of Borrowing

One of the most important factors to pay attention to when considering a loan is the annual percentage rate, or APR. Unlike a simple interest rate, APR gives you the full picture of what borrowing will actually cost you over time. It includes not just the interest, but also any fees or compounding charges, making it the most reliable way to compare loan offers.

APR can vary widely depending on the lender, the type of loan, and—most importantly—your credit score. Generally, the higher your credit score, the lower your APR will be, since lenders see you as less of a risk. On the flip side, if your credit isn’t great, you may see higher APRs, meaning you’ll pay more in interest over the life of the loan.

Before applying for any loan, it’s crucial to look beyond just the monthly payment. Take time to review the APR and add up the total cost of the loan, including all fees. This helps you avoid surprises down the road and ensures the loan truly fits your budget. Factors like the loan amount and the length of the repayment term can also impact your APR, so consider these carefully.

Comparing APRs from multiple lenders helps you find the most affordable option. Remember, a little extra research at the start can save you a lot of money—and stress—over the life of your loan.

Borrow Money with Bad Credit: Planning for Success

If you have bad credit, the idea of borrowing money can feel intimidating. You might worry about being turned down or facing sky-high interest rates. But the good news is that there are still options available, from specialized bad credit loans to no credit check loans designed for urgent needs.

The key is to approach the process with your eyes wide open. Always review the loan’s terms and conditions carefully. Look closely at the interest rates, fees, and repayment requirements. Some lenders are more transparent and offer flexible terms, while others may hide high costs in the fine print.

Before applying, take an honest look at your financial situation. Ask yourself how much you truly need to borrow, and if you’ll be able to manage the payments comfortably. Planning ahead can help you avoid the debt traps that often come with high-interest loans.

Budgeting is especially important when your credit is less than perfect. Make sure you have a plan to repay the loan on time—on-time payments can actually help you rebuild your credit over time. Borrowing with bad credit isn’t impossible, but it does require extra care, thorough research, and a focus on long-term financial health.

Loan Customer Reviews: Learning from Real Borrowers

After understanding loan types, APRs, and what to look for in a lender, it’s wise to tap into one of the most valuable resources available—other borrowers’ experiences. Loan customer reviews can offer a firsthand look at what it’s really like to work with a particular lender, beyond what’s promised in advertisements or on the lender’s website.

When you read through reviews, you’ll gain insight into how a lender handles customer service, whether they’re transparent about fees, and if they deliver on their promises. Did borrowers feel supported during the application process? Were there any hidden fees or unexpected issues with repayment? These are the kinds of real-life details that reviews can reveal.

It’s always best to consult multiple sources. Look at reviews on the lender’s official site, but also check independent platforms like Trustpilot, Google, or the Better Business Bureau. This gives you a fuller, more balanced picture. Keep in mind that some reviews may be fake or overly biased, especially if they seem too generic or overly enthusiastic. Take the time to read both positive and negative feedback to spot common patterns.

Some lenders really do stand out for their positive reviews and flexible loan options, but don’t let one glowing report sway you—consider the bigger picture. By researching a range of reviews, you’ll be better equipped to choose a lender that values transparency, fair terms, and good customer support. This extra step can provide peace of mind and help you avoid unpleasant surprises down the road.

Contacting Lenders: Getting the Clarity You Need

Once you’ve narrowed down your choices and read through customer reviews, the next smart step is reaching out to lenders directly. Contacting lenders gives you the chance to ask specific questions, clarify any confusing terms, and get a sense for how responsive and helpful their customer support really is.

Most reputable lenders offer several ways to get in touch: phone, email, or live online chat. If you’re unsure about any aspect of the loan—whether it’s the interest rate, fees, repayment schedule, or approval process—don’t hesitate to ask. Good lenders will be happy to provide clear, straightforward answers without making you feel rushed or pressured.

Before you make that call or send an email, review the loan terms and conditions carefully so you know exactly what to ask about. Bring up anything you don’t understand, and pay attention to how the lender responds. Are they patient and informative, or do they use high-pressure tactics to get you to sign up quickly? Trust your instincts—if something feels off, it probably is.

Contacting lenders not only helps you get the answers you need, but also gives you a feel for their customer service style. A helpful, transparent lender is a good sign that you’ll be supported throughout your loan journey. Taking the time to reach out can help ensure you make an informed decision and choose the loan that’s truly right for you.

Best Bad Credit Loan Providers with Guaranteed Approval Summary

In 2025, LowCreditFinance stands out as the top bad credit loan provider with guaranteed approval, offering fast, flexible funding solutions for borrowers of all backgrounds.

With an easy online application, a vast network of reputable lenders, and a commitment to transparency, LowCreditFinance makes it simple to access loans up to $50,000—even if your credit score is less than perfect.

You’ll benefit from same-day decisions, customizable repayment terms, and no hidden fees, ensuring a stress-free borrowing experience.

If you need quick cash and want a lender that puts your needs first, LowCreditFinance is the trusted, hassle-free choice for anyone looking to secure emergency funds or manage financial challenges in 2025.

Legal Notice and Affiliate Transparency

This article is intended solely for informational and educational use and should not be interpreted as financial, legal, or professional counsel. The content is based on publicly accessible sources and third-party data considered reliable at the time of writing; however, we cannot guarantee the accuracy, completeness, or timeliness of the information provided.

Loan terms, interest rates, and product availability are determined by external lenders and may change at any time without prior notice. Readers are strongly encouraged to perform their own research and consult a qualified financial advisor or legal expert before making any financial choices.

The service discussed in this article, MoneyMutual, acts as a loan marketplace, not a direct lender. They do not provide loans or make credit decisions, but rather connect borrowers with independent lending partners. All loan agreements, terms, and conditions are strictly between the borrower and the chosen lender.

Some links or references in this article may be affiliated. If you click on a link and take action—such as submitting a loan request or accepting an offer—we may receive a commission at no additional cost to you. This potential compensation does not affect our editorial content or recommendations.

By using this article, you acknowledge and accept that:

- You are responsible for verifying loan offers and lender details independently.

- The content is not tailored as personal financial advice.

- The publisher and contributors are not liable for any financial decisions or damages resulting from the information shared here.

- All trademarks and brand names belong to their respective owners; mention of third-party services does not imply endorsement.

For the most current loan terms, eligibility criteria, and product information, always review the official website of the respective lender.

Media Contact: Tony Stevens

Website: https://www.lowcreditfinance.com

Email: support@lowcreditfinance.com

102 W Service Rd, Apt: 820, Champlain, NY 12919

Attachment

Media Contact: Tony Stevens

Website: https://www.lowcreditfinance.com

Email: support@lowcreditfinance.com

102 W Service Rd, Apt: 820, Champlain, NY 12919

Distribution channels: Banking, Finance & Investment Industry, Media, Advertising & PR

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release