High-Volume Retail Firms Outsource Accounts Payable Services to Manage Complex USA Payment Routines

Retail leaders in the USA streamline operations and gain control as they outsource accounts payable services efficiently.

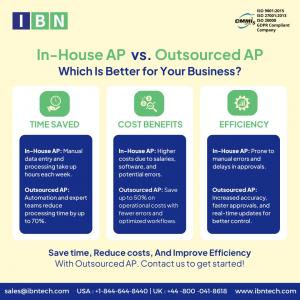

MIAMI, FL, UNITED STATES, July 8, 2025 /EINPresswire.com/ -- Retail organizations handling nationwide distribution and multichannel sales are increasingly restructuring their finance operations to stay agile. Many large retailers are turning toward specialized partners to streamline backend processing and stabilize payment handling. As operations expand with supplier variety and frequent transaction loads, several U.S.-based retail groups outsource accounts payable services to gain better visibility, manage vendor timelines, and reduce manual entries that slow reconciliation.Firms are aligning their payables workflows with clear financial targets by partnering with experienced AP providers. From routine invoice validation to detailed payment scheduling, third-party experts help retail finance teams maintain regulatory accuracy and accelerate documentation cycles. An organized approach to accounts payable audit has become essential as companies prepare assessments and supplier negotiations. This strategy is proving effective for retailers, aiming to improve payout timing, reduce overpayment risk, and strengthen supplier confidence. By assigning AP responsibilities to trusted service teams, retail decision-makers are finding room to prioritize forward-looking tasks and refine spending control throughout their procurement flow.

Reduce errors in payment cycles and reconciliations

Get a Free Consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Manual AP Pressure in Retail

Retail businesses are facing financial pressure due to inflation, changing supplier rates, and increased operating expenses. Manual accounts payable (AP) processes reveal limitations as retailers deal with fast-moving inventory cycles and tight cash margins.

▪ Repeated delays in supplier payment approvals and processing

▪ Frequent errors in invoice matching and vendor terms reconciliation

▪ High dependency on email threads and paper-based invoice tracking

▪ Limited visibility into outstanding payables across store locations

▪ Difficulty managing payment schedules during seasonal demand shifts

▪ Rising administrative workload for short-term procurement cycles

▪ Missed early payment discounts due to process delays

▪ Fragmented reporting across departments and warehouse units

▪ Inconsistent record-keeping affecting financial accuracy

▪ Strain on internal teams during high-volume periods

Retail finance teams are working to resolve these friction points by aligning their AP efforts with experienced professionals who understand the pace and structure of the retail environment. As invoice volumes grow and vendor relationships require consistency, many are turning toward structured solutions that bring process clarity and operational control. Companies now benefit from accounts payable outsource providers who serve reliable support for high-volume cycles, and many are choosing to outsource accounts payable services to enhance visibility, improve accuracy, and protect vendor trust across operations.

Solutions for AP Optimization

Industry experts continue to emphasize the importance of timely financial decisions in fast-paced retail operations. Business leaders are working with external service partners to address delays, inefficiencies, and process gaps in accounts payable systems. Outsourced professionals offer structured support, accurate delivery, and full-cycle visibility across financial operations.

✅ End-to-end invoice processing aligned with vendor payment requirements

✅ Multi-location accounts payable tracking for centralized retail finance teams

✅ Error-free invoice validation and three-way matching across departments

✅ Real-time visibility into outstanding liabilities and vendor balances

✅ Discount capture support through timely vendor payment scheduling

✅ Centralized data access for reconciliations, audits, and internal reviews

✅ Support for seasonal payment volumes and short procurement cycles

✅ Full compliance with tax, vendor, and payment documentation protocols

✅ Continuous reporting for leadership to improve spending visibility

✅ Hands-on support from accounts payable process specialists

Retail companies are now seeing measurable improvement by turning to experts who provide custom support and insight. Many are choosing to align accounts payable by outsource providers who ensure scalable operations, accuracy, and consistent vendor engagement. Firms like IBN Technologies are leading the way with structured guidance and expert-backed strategies. Several businesses choosing to outsource accounts payable services in New York are receiving strong results, benefiting from clear workflows, financial accuracy, and advisory services designed for retail environments.

Improved Payables Outcomes Confirmed

Retail businesses across New York are reporting stronger financial control through streamlined payables processes. Many are adopting outsource accounts payable services to reduce manual handling and improve overall AP consistency, driving better results with firms like IBN Technologies.

● Invoice processing speed increased by 40%

● Manual checks replaced by defined review steps

● Vendor communication improved through payment schedule accuracy

By working with IBN Technologies, finance teams are reducing discrepancies, building trust with suppliers, and gaining structured visibility over payables. The result is a more dependable, scalable AP function that supports retail growth and ensures operational stability.

Retail Finance Turns to Precision

Retail organizations across the U.S. are increasingly shifting toward structured financial support to manage high-volume vendor payments, seasonal supply chain demands, and multi-store operations. With fluctuating purchase cycles and rising administrative costs, the focus has turned to financial clarity and long-term scalability.

In this changing landscape, more retailers are choosing to outsource accounts payable services to improve accuracy, speed, and internal workload balance. By refining their Accounts Payable process, businesses are achieving faster invoice handling, stronger vendor relationships, and better forecasting alignment. The shift delivers measurable results, helping teams gain clarity in expense tracking, stay audit-ready, and elevate their position in an increasingly competitive market.

The decision to bring in external AP experts is becoming a strategic move, not just for efficiency, but for gaining a reliable structure across financial operations. Companies partnering with experienced providers like IBN Technologies are seeing streamlined implementation, smoother reconciliations, and greater control, driving smarter growth in today’s fast-moving retail economy.

Related Service:

Outsource AP/ AR Automation Services: https://www.ibntech.com/ap-ar-automation/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Distribution channels: Retail

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release